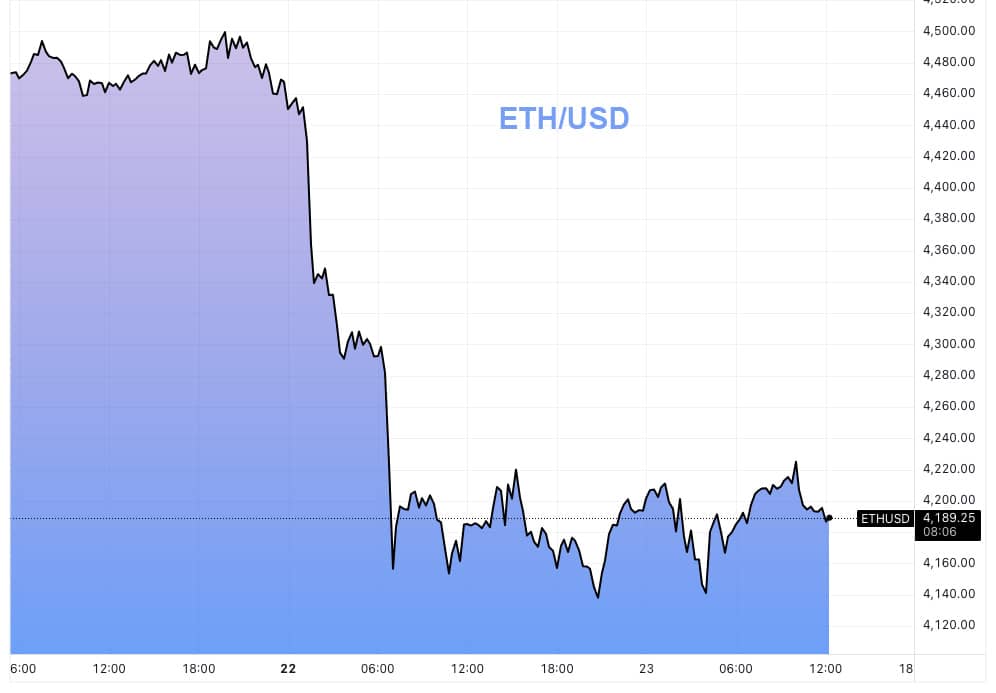

Yesterday £148 billion was wiped from the cryptocurrency market and Bitcoin slipped back under the £84,000 mark.

It was a reminder, not a shock, of just how volatile this asset class is.

Some experts are saying this is just another correction. Others warn it could be the start of something far more serious. The reality is, nobody knows.

That’s the nature of crypto. It trades without fundamentals, it relies heavily on momentum, and when the music pauses the drawdowns can be brutal.

The Crypto Fear and Greed Index is now sitting at 45, pointing to rising caution. September also has history here. For four years running, crypto has been hit hard in this month, and this year seems no different.

Some are even suggesting institutions are selling to scare retail holders out before they step back in for one last rally.

There are also more sober voices saying this is just the maths at work. With Bitcoin’s annualised volatility north of 50%, a £40,000 swing in either direction within a year is statistically normal.

Moves that look shocking in headlines are actually par for the course in this market.

For me, this is the key point. Crypto is not a stable investment. It is an extremely volatile, sentiment-driven market that can wipe out or double your gains in weeks.

That’s why my portfolio allocation is highly cognisant of this volatility. I treat crypto as a speculative sleeve, not a core holding.

Yesterday’s sell-off is not the end of the world, but it is a timely reminder of what we’re dealing with. If you’re in, size your exposure accordingly. If you’re not, don’t get drawn in by the fear of missing out.

Either way, treat it for what it is: a highly volatile asset class where the ride will always be rough.

When designing portfolio exposure to this asset it is the volatility input that is the overarching factor, not the potential upside.