Image courtesy of the Brookings.

Cutting into a high inflation environment is fuel for the BTC fire.

Although crypto's off to a rough start this week, with most coins slipping lower, Bitcoin's actually holding up pretty well above $110,000, but the drop is sharper in names like Solana and Dogecoin.

That said, both of those had huge rallies last week, so this looks more like profit-taking than the end of the broader uptrend.

The spotlight now turns to Jerome Powell tomorrow: this is the week markets expect him to finally give in to pressure from the White House and cut rates.

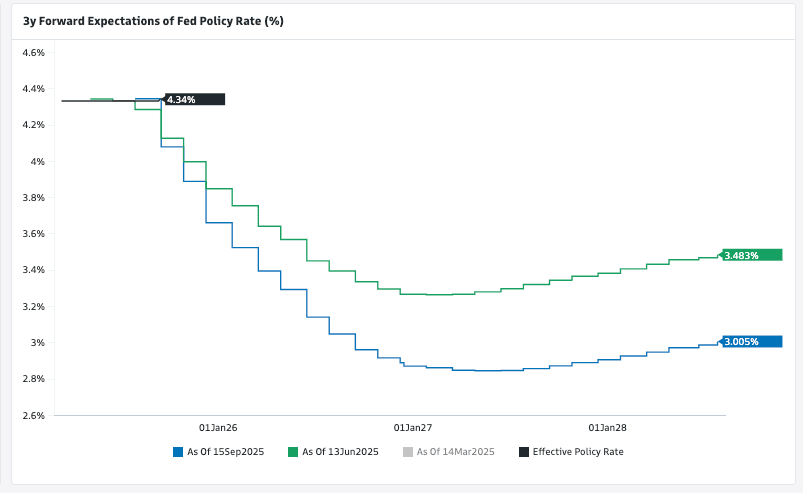

In fact, the market thinks this will be the start of a multi-cut cycle, with up to three more cuts to follow in 2025 alone, and a couple more due in early 2026.

Powell will frame it as a response to weaker jobs data, but there's also a definite sense of political pressure behind the move.

If the Fed affirms market expectations that more cuts are coming, crypto could be one of the biggest winners.

Retail punters think so too: IG, one of the UK's biggest retail trading platforms offers some handy insights, with Bitcoin’s strength last drawing in more traders onto the buy side, to the extent sentiment stands at an 81% long.

Ether remains at last week’s level of 83%, as the price hovers near its August record highs.

The above shows the downshift in Fed pricing that has really given a shot to risk-associated assets.

But more importantly, the market gets the feel that we are in a higher-for-longer inflationary epoch: why wouldn't your think that when the Fed is CUTTING into a an environment of elevated inflation?

One only needs to look at gold for vindication of this view. To the degree that BTC is a an inflation hedge, then we are still firmly in uptrend territory.