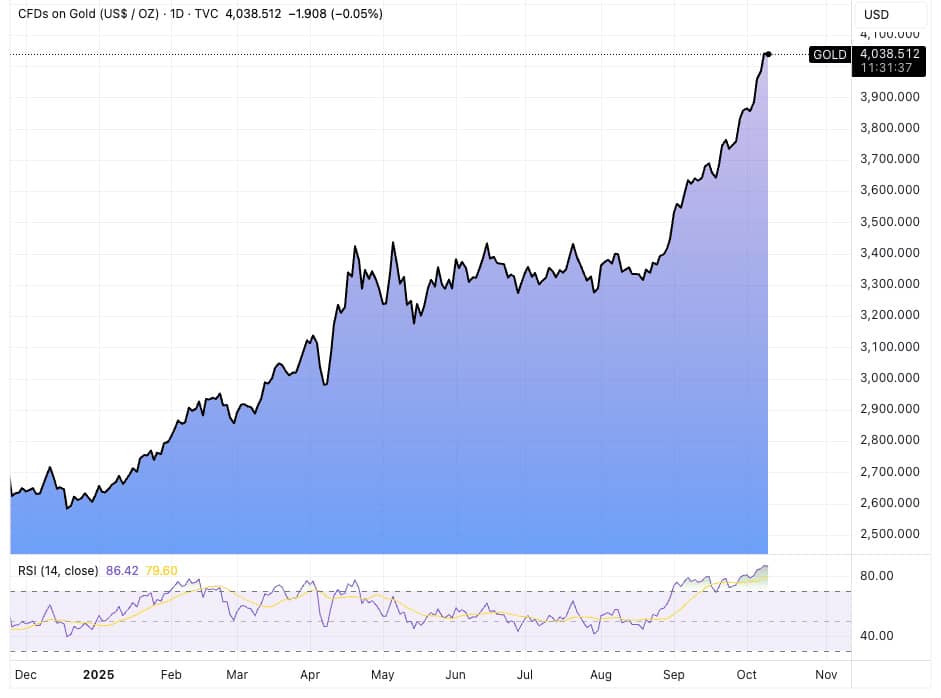

Gold has been one of the standout trades of 2025. It’s broken through $4,000 an ounce, a level that once looked distant even in the most bullish forecasts.

For context, Goldman Sachs now sees the metal reaching nearly $4,900 by the end of next year, which would mean another 20%-plus gain from here.

Gold often features in my portfolio considerations, but the key question now is whether I’ll be adding to that exposure at these levels.

The short answer is not right now.

From where I sit, the gold rally has started to feel crowded.

An ex-colleague of mine who now does research for Swiss private bank J. Safra Sarasin makes this point subtly in a new note.

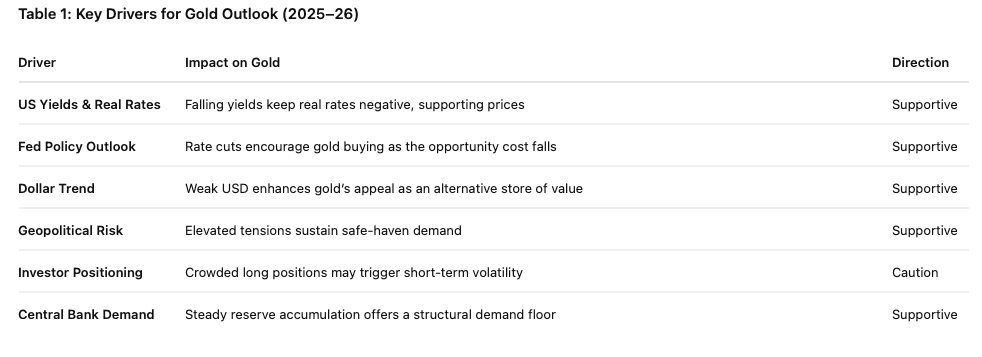

He argues gold’s momentum is now being driven less by fundamentals and more by capital flows reacting to lower US yields, geopolitical stress, and the weak dollar narrative.

Those are still valid supports, but they’re already priced in. When a trade gets this one-sided, the risk/reward balance starts to shift.

He continues to see a favourable medium-term outlook for gold, arguing that the global rate-cutting cycle, slowing growth, and geopolitical risks should keep real yields capped.

But it also cautions that a lot of the good news is already reflected in today’s prices.

His base case sees gold consolidating in the short term before gradually grinding higher again through 2026 as central banks keep adding to reserves and monetary easing filters through.

That fits with my own view:

Gold has done its job as a hedge against uncertainty and currency debasement, but momentum trades eventually run out of steam. When everyone is on the same side of the boat, even small shifts in positioning can cause big moves the other way.

What’s more, there are other ways to express the same macro view without chasing gold at its highs.

The rally has already pulled in vast speculative flows, which means assets still playing catch-up could start to attract attention.

I'm thinking here of other metals and commodities, tokenised real-asset plays, and even Bitcoin, all of which remain comparatively undervalued versus gold but serve similar purposes in a diversified portfolio.

None of this means I’ve lost faith in gold. Far from it. I continue to see it as a core long-term hedge, particularly as global debt levels rise and fiscal credibility erodes.

But my preference now is to hold rather than add. Let the market cool, let some of the froth shake out, and reassess once prices have settled into a more sustainable range.

If the metal does surge toward Goldman’s $4,900 target, it’ll likely do so in a slower, more grinding fashion, not the straight-line move we’ve seen this year. That would also make it easier to re-enter with a cleaner risk setup.

So, my message is simple: gold has earned its place in the portfolio, but new allocations should be approached with caution. The easy money in this leg of the rally has already been made.

From here, patience will matter more than enthusiasm.