Image: Adobe images.

Every year I make a point of looking at UBS’s Global Real Estate Bubble Index. Real estate isn’t a sector I invest in directly — it’s not my speciality and I don’t pretend otherwise — but I do like to keep a wide risk radar.

When one of the world’s largest banks raises bubble concerns in key global property markets, I think it’s worth paying attention.

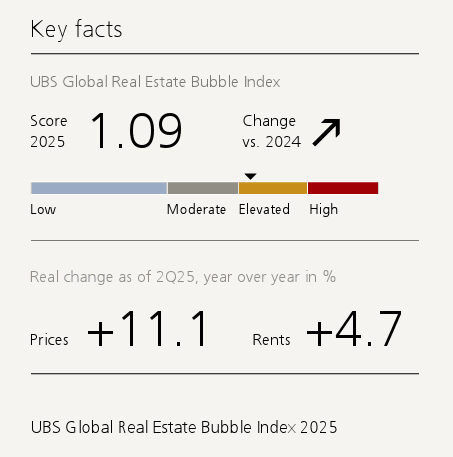

The 2025 edition of UBS’s index puts Madrid and Dubai firmly in the spotlight. Both cities are now flashing bubble risk warnings, and the details are striking.

In Madrid, residential property prices have surged more than 40% since 2017, fuelled by population growth, tight supply, and speculative demand.

UBS finds that affordability has collapsed. Median income earners would need more than 15 years of average salaries to buy a 60-square-metre flat close to the city centre. For context, that’s far worse than the levels seen in the run-up to Spain’s last property crash in 2008.

Dubai tells a slightly different story but one that’s equally concerning. The city has seen house prices jump almost 70% since 2020. UBS describes the pace as “unsustainable,” highlighting how much of the rally has been driven by speculative buying from overseas investors.

Rental yields have compressed, leaving buyers increasingly dependent on price appreciation alone. That’s classic bubble territory.

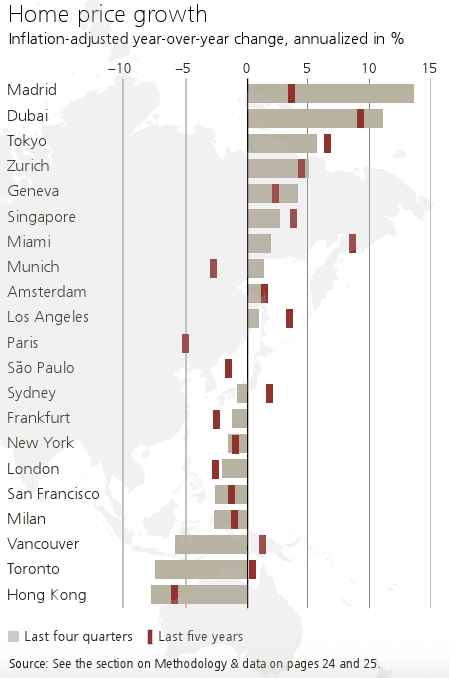

What’s interesting is that not all global cities are in the same boat. UBS notes that in places like Hong Kong, Vancouver, and Stockholm, bubble risk has actually receded as higher rates cooled demand and brought valuations back to more realistic levels. In the US, cities such as Miami and Los Angeles remain expensive but are no longer at peak bubble readings.

In Europe, Paris and Amsterdam are flagged as still expensive but less overheated than in prior years.

That contrast is what I find most useful about the report. It’s not simply saying “property everywhere is in a bubble.” It’s identifying where risks are building, where they’re stabilising, and where previous excesses have been wrung out. Madrid and Dubai stand out because their trajectories are going the other way, i.e. still accelerating at a point where others are cooling.

Above: Dubai's key indicators.

Now, I don’t trade property markets directly.

I don’t buy REITs or invest in development projects. It’s not my lane. But I do pay attention because housing bubbles don’t exist in isolation.

They spill over into banking systems, consumer behaviour, and broader equity sentiment. Spain’s last property bust nearly brought down its banking sector. Dubai’s last correction in 2009 left scars that took years to heal.

That’s why I see this UBS report as a signal. It’s not about rushing to short property developers or dump related equities. It’s about understanding where stresses might show up if global conditions turn. Central banks are cutting rates, liquidity is flowing, and risk assets are rallying. That’s exactly the kind of backdrop where bubbles inflate most easily.

For me, Madrid and Dubai are now on the “pinging radar” list. If prices keep inflating at current rates, the probability of a sharp correction rises.

That matters for banks with exposure to Spanish or Middle Eastern mortgages, for sovereign funds tied to Dubai real estate, and for global investors who assume property is a one-way bet.

I’ll repeat: I don’t dabble in real estate directly. But I do watch these signals closely because bubbles have a habit of ending in ways that affect everyone.

UBS’s warning is a timely reminder that not all risks sit in equities or bonds. Sometimes the biggest signals come from the bricks and mortar world.