Image © Adobe Images

Britain's government has launched a formal consultation to overhaul how remote gambling is taxed, a move that could significantly alter the operating landscape for online betting and gaming firms.

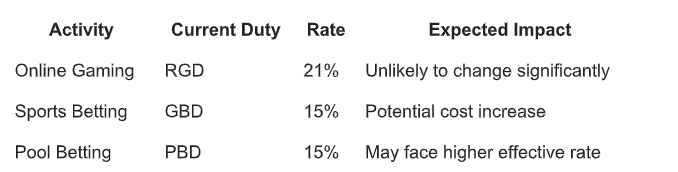

The proposed reform, initiated in 2025, aims to consolidate three existing levies, Remote Gaming Duty (RGD), General Betting Duty (GBD) and Pool Betting Duty (PBD), into a single Remote Betting and Gaming Duty (RBGD).

The plan is billed as a simplification measure, but industry leaders warn it could result in higher tax burdens for some operators and reshape market dynamics.

Currently, different gambling activities are taxed at varying rates. Online casino games are subject to RGD at 21%, while sports and pool betting are taxed at 15% under GBD and PBD, respectively.

A unified tax rate under RBGD could eliminate these distinctions.

"If the new rate aligns closer to 21%, sports and pool betting operators would see a notable cost increase," said a tax advisor to a UK-based gaming firm Slotozilla. "That could significantly compress margins in already competitive segments."

For operators, a unified tax regime could bring administrative relief, but at a financial cost. Reduced compliance complexity may be offset by tighter profit margins, particularly for firms that rely heavily on promotions, bonuses and loyalty schemes.

Analysts say operators may respond by scaling back player incentives or restructuring their product mix to prioritise higher-margin offerings.

"The economics of free bets and slot tournaments could change quickly,” one industry executive said. "Some companies may rethink entire verticals."

This could also affect the range and value of casino offers in the UK on the Slotozilla platform, which are often used to attract and retain players in a highly competitive environment.

Smaller operators could benefit from simplified licensing and reporting structures, but might struggle to absorb cost increases, raising questions about long-term market diversity.

Higher costs could result in fewer customer promotions, potentially prompting users to seek offshore alternatives. These unregulated sites, though lacking consumer safeguards, often offer more aggressive payouts.

"There’s a real risk of driving players to black-market platforms," said a spokesperson for the Betting and Gaming Council (BGC), which represents licensed operators. “If regulated firms are overburdened, it weakens the system as a whole."

The BGC has warned that the reform could act as a "stealth tax increase," especially if set without balancing incentives. The group also highlighted the knock-on impact on horse racing and other sectors reliant on betting revenue through statutory levy schemes.

Online gambling contributes over £3BN annually to UK tax revenues, and the broader sector supports tens of thousands of jobs. A more efficient tax system could sustain this contribution while encouraging new entrants by lowering barriers to compliance.

However, industry advocates caution that a higher blended rate could trigger retrenchment. Cost-cutting may extend to jobs, marketing, and sponsorships, potentially affecting regional economies where gambling companies play a central role.

Government officials say the consultation process will weigh fairness, revenue stability, and market sustainability. No final rate has yet been set.