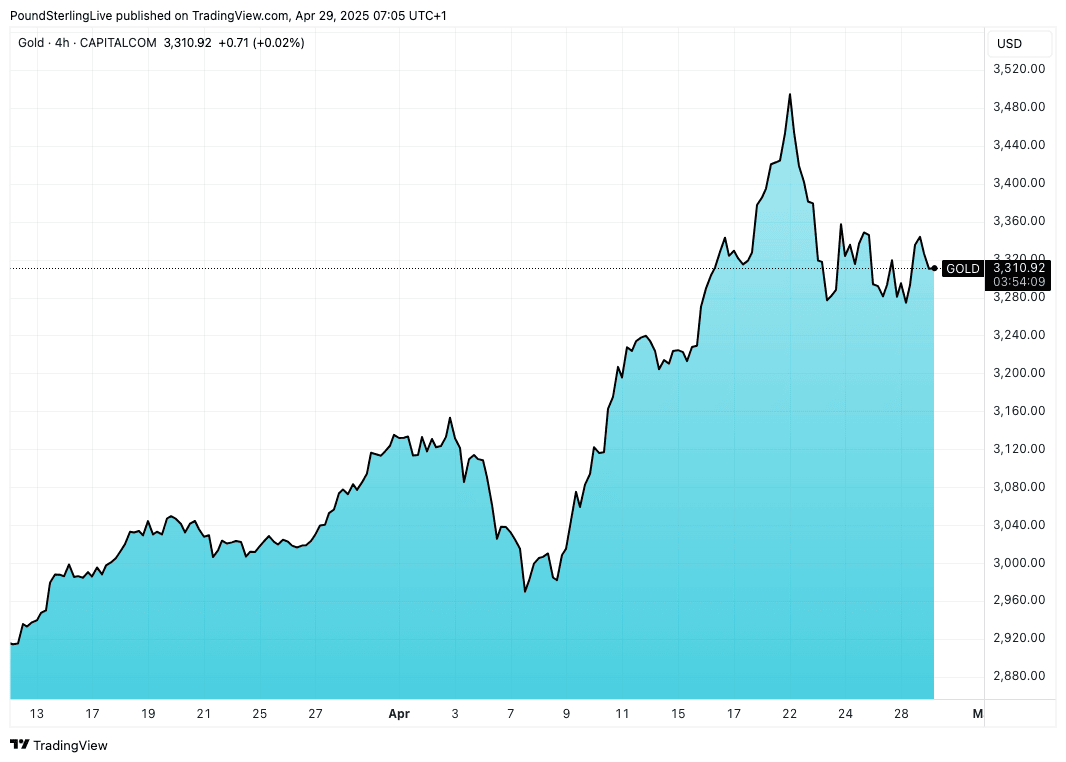

Gold prices have reached unprecedented levels in 2025, with spot gold surpassing $3,500 per ounce for the first time in history.

This surge, amounting to a 29% increase year-to-date, is largely attributed to escalating global economic uncertainties, including heightened U.S. tariffs and ongoing geopolitical tensions.

Major financial institutions have adjusted their forecasts in response to these developments. J.P. Morgan anticipates gold prices averaging $3,675 per ounce by the fourth quarter of 2025, with potential to exceed $4,000 by the second quarter of 2026, driven by sustained investor and central bank demand.

Similarly, Goldman Sachs has revised its year-end 2025 forecast to $3,700 per ounce, noting that in extreme scenarios, prices could approach $4,500.

The rally in gold prices is also influenced by investors seeking safe-haven assets amid market volatility.

Traditional safe assets like U.S. Treasury bonds and the dollar have experienced instability, prompting a shift towards gold.

Analysts suggest that unless significant policy changes occur, gold's upward trajectory is likely to continue, solidifying its status as a reliable store of value during times of economic turbulence.

Another major driver of gold’s surge in 2025 is the growing interest in Gold IRAs (Individual Retirement Accounts). With traditional investments like stocks and bonds experiencing volatility and underperforming due to inflationary pressures and global uncertainty, more Americans are choosing to diversify their retirement savings with physical gold.

Investors are increasingly seeing gold not just as a commodity, but as a hedge against inflation, currency devaluation, and systemic financial risk.

The appeal of gold in retirement portfolios lies in its historical stability. Unlike paper assets, gold is a tangible asset with intrinsic value, making it resistant to market crashes and economic downturns.

Financial advisors are reporting a sharp uptick in clients requesting to roll over part of their 401(k) or IRA into a self-directed Gold IRA.

This option allows investors to hold IRS-approved gold and other precious metals within a tax-advantaged retirement account, offering both diversification and peace of mind.

This transaction can only be done with a gold IRA custodian which serves as an intermediary to keep the retirement account adhering to the guidelines of the IRS.

The Federal Reserve's shifting stance on interest rates, along with increasing global debt levels, has only strengthened the case for gold. As the dollar weakens in purchasing power and fears of a recession loom, retirees and near-retirees are prioritising assets that can preserve wealth rather than chase high-risk gains.

In 2025, gold is no longer just an emergency asset — it’s becoming a mainstay in long-term financial planning.

Adding to the momentum are prominent gold dealers and financial firms launching aggressive education campaigns on the benefits of Gold IRAs.

Many are offering free guides, consultations, and even promotional incentives to encourage investors to make the switch. Combined with recent headlines about bank instability and declining confidence in government-backed assets, these efforts are striking a chord with investors who want greater control over their retirement futures.

In essence, gold’s resurgence isn’t just about short-term speculation — it’s a response to a larger shift in how people think about wealth protection. As the global economic landscape grows more unpredictable, gold is shining bright as a safe, strategic, and secure retirement asset for the years ahead.