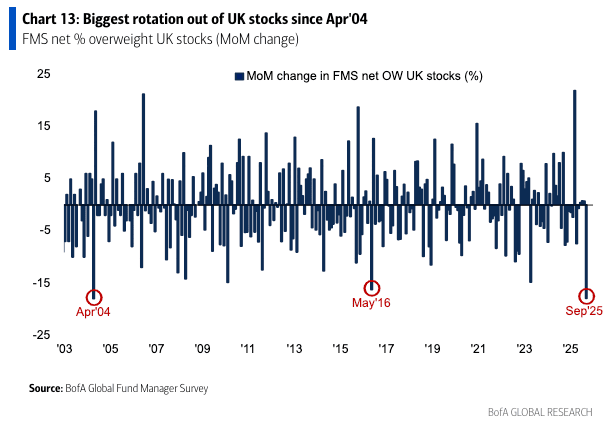

Global investors piled into UK stocks earlier in the year as the big ex-U.S. rotation took place.

However, fast-forward and the U.S. is back in vogue and the dreary UK is funding a renewed pile-on targeting U.S. growth stocks.

We get these insights from the Bank of America global fund survey; it shows September saw the biggest monthly rotation out of UK equities (from net 2% UW to net 20% UW) since Apr'04.

FMS allocation to UK stocks is now the lowest since Mar'24.

UK stocks are stuttering a bit with the FTSE 250 losing its edge, while the FTSE 100 trades below all-time highs. At the same time, the big U.S. indicies are printing a run of fresh records.

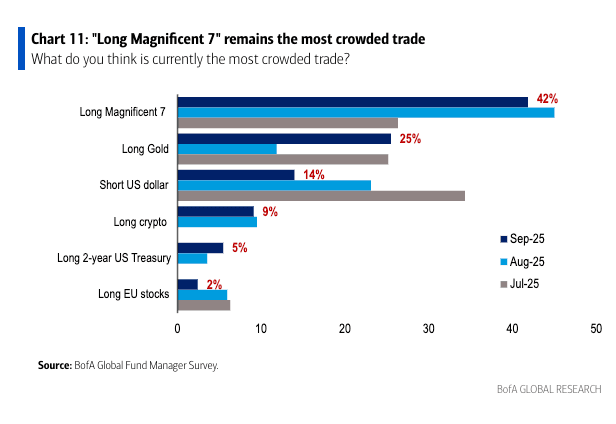

Bank of America's much-watched survey shows the "Long Magnificent 7" remains the most crowded trade for the 2nd month running, according to 42% of investors surveyed.

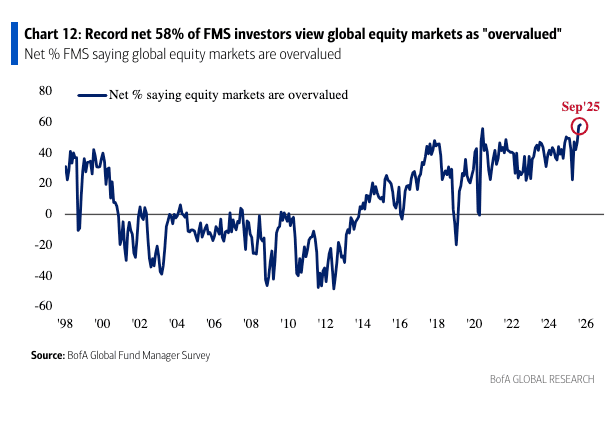

Also, investors recognise that markets are heavily overvalued, with a record 58% of fund managers viewing global equity markets as overvalued, up slightly from 57% in August.

So they know, and we know equities are overvalued, but the pain trade remains betting against this bull.