Image © Adobe Stock

The past six months have been all about US tech. The S&P 500 has soared to record highs since April, up more than 12% this year, with AI-driven names leading the charge.

But valuations are now stretched, and many of the positive catalysts for tech have already been priced in. That’s why I think the next leg of this rally is going to look different.

Healthcare - and in particular Swiss pharma - is where I see room for upside.

Lombard Odier's CIO office points out that policy uncertainty, which has been the biggest drag on healthcare stocks, looks to have peaked. The sector has already absorbed the bad news around drug pricing, regulation, and tariffs.

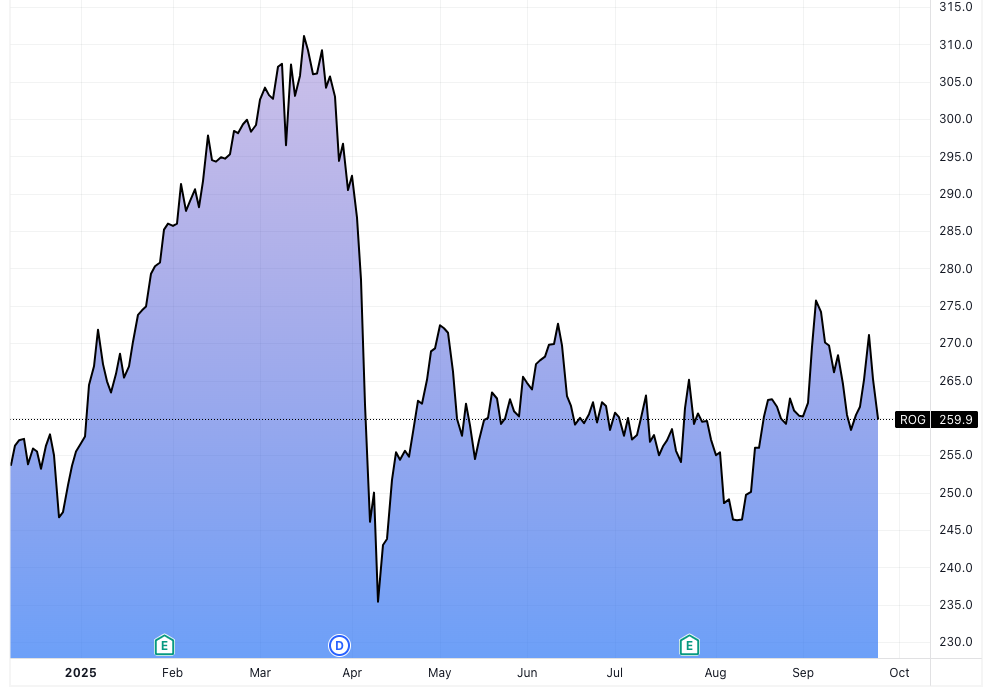

Above: Roche Holdings took a hit on the April 'liberation day' announcements.

In fact, Swiss pharmaceutical exports have been spared the worst of US tariff threats, and with a cap now in place, the tail risk for Swiss names is lower than feared.

That matters, because these stocks have been under-owned and oversold for years, leaving them with more potential to bounce as visibility improves.

The earnings cycle also looks supportive.

After a tough 2025, Lombard Odier expects a strong recovery for Swiss corporates in 2026 and 2027, with healthcare and financials doing most of the heavy lifting. In other words, the two sectors investors have been ignoring may end up delivering the bulk of the returns.

For me, this is exactly the type of rotation that makes sense at this stage of the cycle. Tech has done its job, but if the rally is going to sustain itself, it needs to broaden.

Swiss pharma offers high-quality balance sheets, global demand, and valuations that still look attractive compared to stretched US peers.

So while I’m not abandoning tech, I'm starting to tilt portfolios toward healthcare, with Swiss pharma right at the core of that strategy.