Image credit: Adobe.

When I look across the AI landscape, I’m less interested in the headline-grabbing models and more focused on the infrastructure and applications that make them usable at scale.

That’s why Workday stands out to me.

It’s one of the cleanest ways to get exposure to AI without betting on which model or agent 'wins.'

Workday is the pick-and-shovel provider here, and it’s quietly building a durable franchise around data, workflows, and enterprise integration.

Citi’s Steven Enders recently summed it up well. After attending Workday’s Rising user conference, he highlighted how management positioned the platform as a “system of record” not just for people and money, but now for AI agents as well.

That’s an ambitious framing, but it makes sense when you consider Workday’s scale: over a trillion transactions and 75 million users.

Their AI-driven products are already generating $450M in annual recurring revenue, growing 50% year-over-year, with “agentic” products up 200% year-over-year.

Citi acknowledged that growth forecasts have been nudged down to 13–14% CAGR through FY28, but they view the improved margin target of 35% non-GAAP by FY28 as a positive trade-off.

Morgan Stanley reinforced this point, noting Workday’s ability to sustain 20%+ FCF per share CAGR through FY28, anchored by what they call a “Rule of 48%.”

The drivers here aren’t just financial discipline, but a real expansion of the AI opportunity set: the new Data Cloud, deeper partner integrations, and a developer base that’s doubled.

Their argument is straightforward: if Workday can execute on monetisation levers like Flex Credits while maintaining revenue momentum, the long-term financial framework looks achievable.

That execution theme is also why Elliott Investment Management, one of Workday’s biggest shareholders with a $2B stake, has publicly thrown its weight behind the company.

In their words, Workday is now a “unique software franchise” with industry-leading retention and a proven management team. For a sometimes-sceptical activist, that’s about as close to an endorsement as you’ll get.

On the sell-side, the tone is shifting:

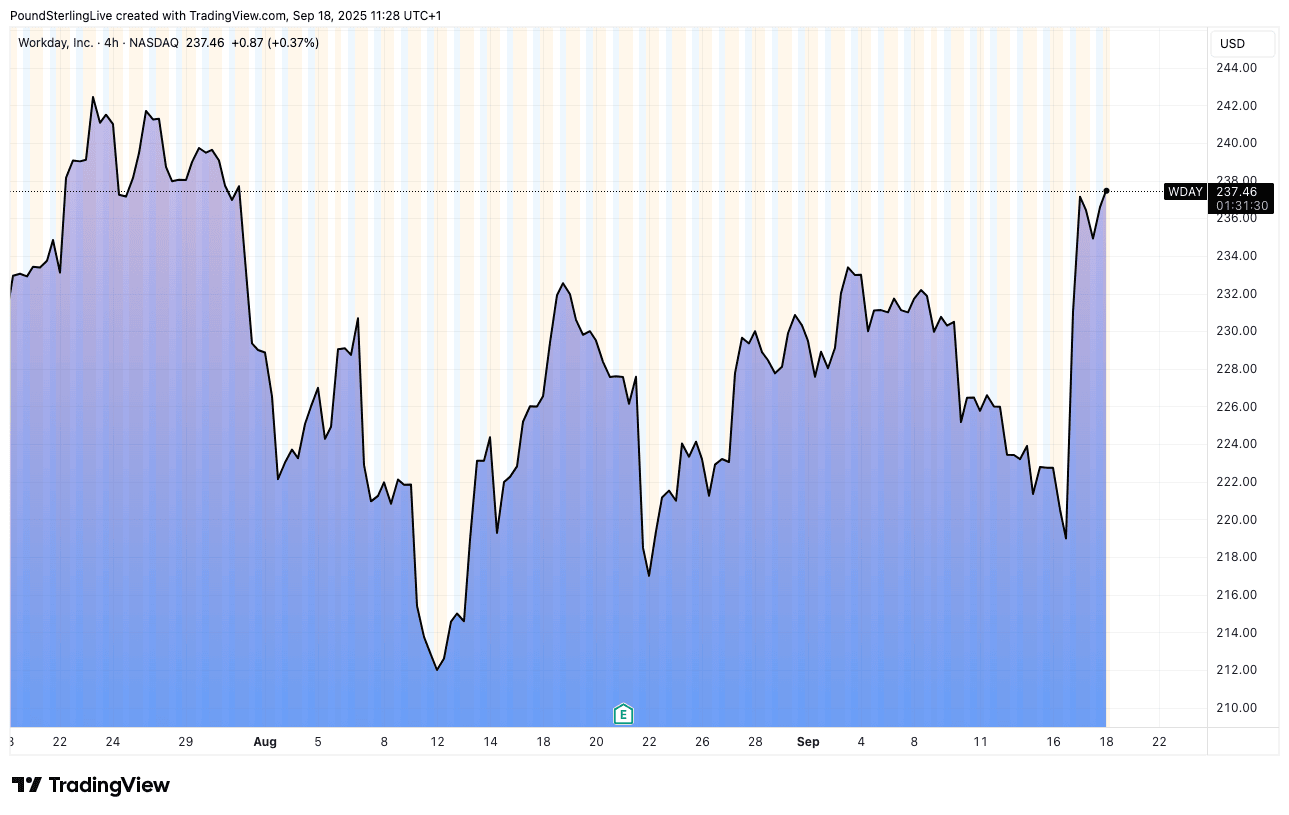

Piper, once bearish, has upgraded the stock to Neutral with a raised price target of $235. Their thesis? Workday is pushing harder to stay at the front of the AI pack. They point to three acquisitions in the last month alone, adding 1,300 employees with AI expertise, plus product innovation like Flex Credits that reframe pricing around consumption. The valuation also plays a role — with EV/FCF at a 10-year trough near 18.8x, risk and reward now look balanced.

And Guggenheim has gone a step further, upgrading to Buy with a $285 price target. Their case is that Workday is stronger today than it has been in years.

They see deeper partner engagement, global payroll expansion, and continued double-digit growth even in a cautious IT spending environment.

Guggenheim is realistic about costs tied to Workday’s proprietary infrastructure, but they argue consistent execution outweighs that risk, especially with buybacks, activist support, and new leadership hires in the mix.

So, here’s my bottom line. Workday may not be the flashiest name in AI, but it’s one of the most strategically positioned. Its scale, sticky customer base, and growing AI monetisation make it a rare “infrastructure” play that already earns real cash flow. The Street is waking up to this, activists are backing it, and the valuation is still reasonable.

That’s why, in my book, Workday is one of the best AI pick-and-shovel bets available today.